PB ratio compares a companys stock price with the book value of its assets. Both PE and PB ratios are valuation ratios and help investors evaluate whether a.

Price To Book Value Ratio Guide Examples Of P B Ratio

Also known as the PB ratio it compares the market and book value of the company.

/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

What is pb ratio in stock market. Uses of the PB ratio. Its calculated by dividing the companys stock price per share by its book value per. Book value per share refers to the total shareholders investment in the company divided by shares outstanding.

The price to book ratio also known as the market to book ratio is a financial ratio that helps us determine if the stock of a company is overvalued or undervalued. 30 then the PB ratio is 12. It is calculated by one of the two methods outlined in this article.

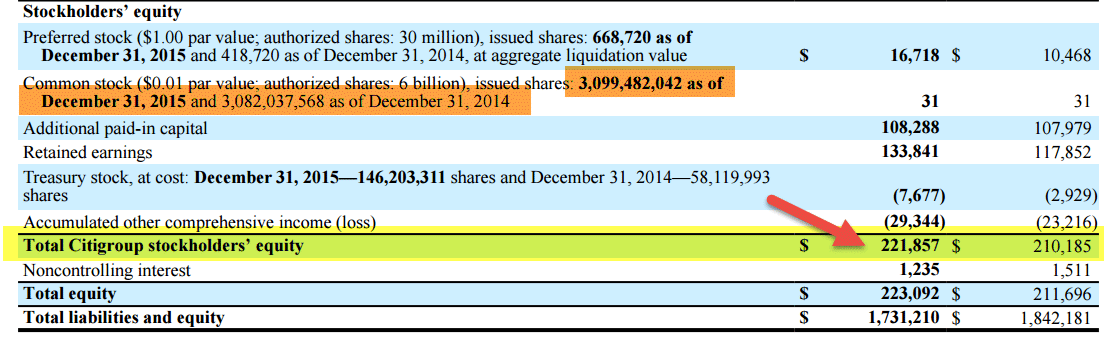

Price To Book Ratio often simply referred to as PB Ratio can be used to make a comparison between the current market price of a stock and the total book value of all the assets that company has on the balance sheet. The price-to-book ratio or PB ratio is a financial ratio used to compare a companys current market value to its book value where book value is the value of all assets owned by a company. The book value is the balance sheet valuation of the company divided by the number of shares of the companys stock in the stock market.

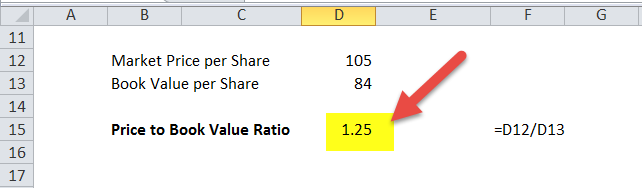

Quite simply the PB ratio is the price of the stock divided by the stocks book value. Price to Book Value Calculation Let us now apply Price to Book Value formula Book Value Formula The book value formula determines the net asset value receivable by the common shareholders if the company. Basically the price to book value ratio compares the level of a companys market share price to its book value per share.

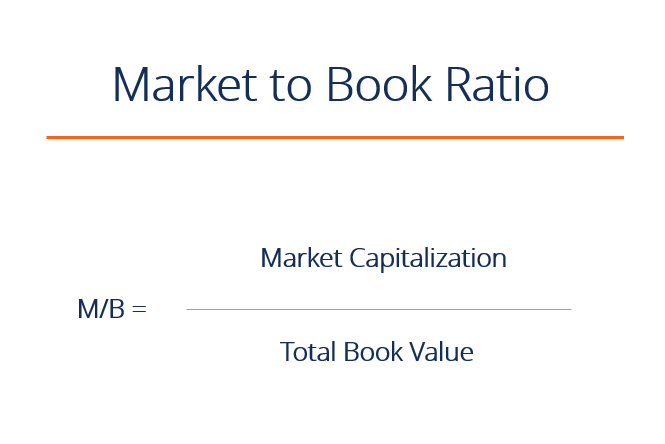

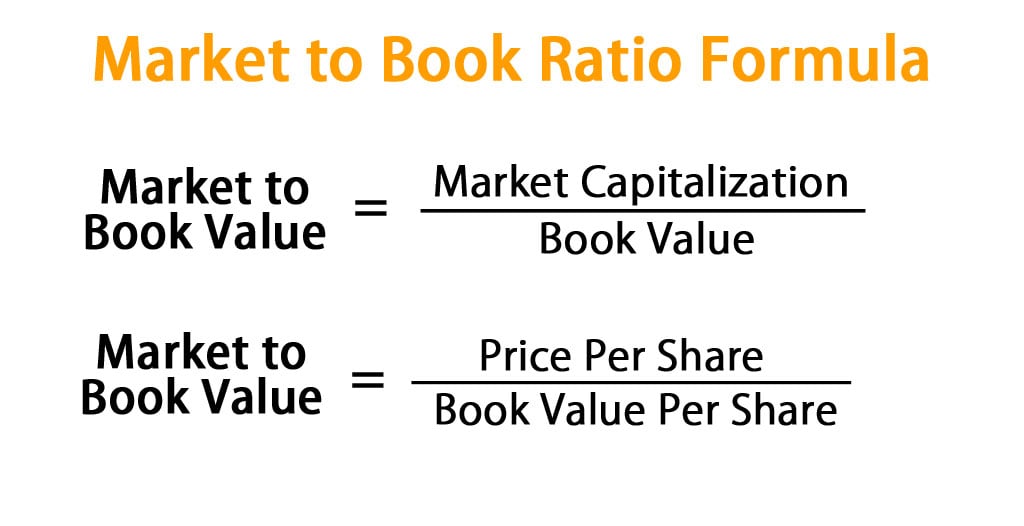

It is best to compare Market to Book ratios between companies within the same industry. Example Calculation of Market to Book Ratio in Excel. A financial ratio that is used to compare market value of a stock to its book value is called price to book ratio or PB ratio.

Companies use the price-to-book ratio PB ratio to compare a firms market capitalization to its book value. PB ratio Market price per share Book value of assets per share Lets consider an example. PB ratio is one of the key fundamental ratios to analyze stocks Price to Book Ratio or PB Ratio is used to determine the valuation of the company with respect to its balance sheet strength.

The PB ratio is essential for value investors- investors looking to purchase undervalued stock with the presumption that in the future the market value of the stock will rise and they can sell off their shares at a profit. Price-to-Book Ratio also called PB ratio is a financial valuation tool used to evaluate whether the stock a company is over or undervalued by comparing the price of all outstanding shares with the net assets of the company. The PB ratio is one of the measures you can use when evaluating the fundamentals a stock.

PB ratios relationship with stock market returns How closely are the historical sector specific PB ratios correlated with stock market returns. The calculation can be performed in two ways but the result should be the same. This ratio is calculated as recent close price of the stock divided by book value per share of the company for the most recent financial year.

The market-to-book ratio helps a company determine whether or not its asset value is comparable to the market price of its stock. If the market price of a stock is Rs. If this ratio of the stock is 5x this implies that the current market price of the share is trading at 5 times the book value as obtained from the balance sheet.

If you calculate a simple historical correlation of the historical PB ratios of a sector and the 3-year forward return the total return during the period of the next three years of the sector you will get a negative correlation for all. The stocks of Company JOE trades at a market value of Rs95share. Whereas PE ratio compares a companys share price with its long-term earnings potential.

The Market to Book ratio or Price to Book ratio can easily be calculated.

What Is P B Ratio Complete Details Yadnya Investment Academy

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

Using The Price To Book P B Ratio To Evaluate Companies

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Price To Book Ratio P B Ratio Financial Edge

Price To Book Value Formula How To Calculate P B Ratio

Market To Book Ratio Price To Book Formula Examples Interpretation

Price To Book Value Formula Calculator Excel Template

Using The Price To Book Ratio To Analyze Stocks The Motley Fool

P B Ratios For Largest U S Banks Soar In Response To Trump S Victory Nasdaq

Price To Book Value Formula How To Calculate P B Ratio

Price To Book Value Formula Calculator Excel Template

What Is Price To Book Ratio Definition Formula How To Use It

Market To Book Ratio Formula Calculator Excel Template

What Are The Current Price To Book Ratios For The Largest U S Banks

/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

What Is Price To Book P B Ratio

What Is The Justified Price To Book P B Ratio The Finanalyst

Price To Book Value Formula How To Calculate P B Ratio

Price To Book Ratio How To Analyze Stocks

Post a Comment

Post a Comment